It is not a capital expense. Unlike tax reliefs tax deductions reduce the amount of your aggregate income which is the sum of your total.

T Glide Files How To Retrieve And Insert Filing System Accounting Office Office Filing System

Paragraph 33 1 c of the ITA allows a deduction for the expenses wholly and exclusively incurred for.

. The deduction is limited to 10 of the aggregate income of that company for a year of assessment. Medical expenses for serious diseases for self spouse or child. The key issue that one should pay attention when claiming a tax deduction is whether the expenditure is wholly and exclusively incurred in the production.

These tax incentives appear in various forms such as EXEMPTION ON INCOME EXTRA ALLOWANCES ON CAPITAL EXPENDITURE INCURRED DOUBLE DEDUCTION OF EXPENSES SPECIAL DEDUCTION OF EXPENSES PREFERENTIAL TAX TREATMENTS FOR PROMOTED SECTORS EXEMPTION OF IMPORT DUTY AND EXCISE DUTY Malaysia offers a wide range of. Stay in Malaysia less than 182 days are taxed at flat rate of 28 without any personal reliefsdeductions and rebates. The tax rate for sole proprietorship or partnership will follow the tax rate of an individual.

Generally repairs and renewals expenses are claimed as deductions from a persons gross income from a business or rental source. UPDATED AS AT 11052022 UPDATED AS AT 11052022. The below are some expenditures generally deductible for tax.

Firstly the outgoings and expenses referred to by section 33 must strictly speaking be revenue in nature ie. The expenses that are not income tax deductible are initial expenses before the property is rented out including. LEGAL and professional expenses are deductible under the Income Tax Act 1967 ITA when they are incurred in the maintenance of trade rights or trade facilities existing or alleged to exist.

In general medical fee for the employee is tax-deductible under S 33 of the Income Tax Act 1967. Corporate income tax deduction is allowed for expenses wholly and exclusively incurred in the production of income. For small and medium enterprise SME the first RM600000 Chargeable Income will be tax at 17 and the Chargeable Income above RM600000 will be tax at 24.

A deduction is allowed for cash donations to approved institutions defined made in the basis period for a year of assessment. Thus his chargeable income after taking the tax deduction for his donation into account is RM60000 RM6000 RM54000 thus lowering the amount of tax he has to pay. Fines and penalties Fines and penalties are generally not deductible.

Salary and wages Business insurance Advertisement and promotion expenses Employee travelling expenses Entertainment expenses Repair and maintenance Lease rental on plants and machinery Recruitment expenses. CHARTERED TAX INSTITUTE OF MALAYSIA 225750-T e-CTIM No852012 20 June 2012 TO ALL MEMBERS TECHNICAL Guidelines on Deduction for Expenses under paragraphs 346m 346ma ITA 1967 for Income Tax Computation The Inland Revenue Board IRB issued the above guidelines on 6 June 2012. Tax is governed strictly by tax laws which in Malaysia is principally the Income Tax Act 1967 ITA.

Pursuing a full-time degree or equivalent including Masters or Doctorate outside of Malaysia. The SME company means company incorporated in Malaysia with a paid up capital of. The repair of premises plant machinery or fixtures employed in the production of gross income.

Whereas in partnership the chargeable income is divided among the partners as an individual. The legislation dealing with the general deduction is stated in Section 331 of the ITA. Currently expenses incurred on secretarial and tax filing fees are given a tax deduction of up to RM5000 and RM10000 respectively for each year of assessment YA under the Income Tax Deduction for Expenses in relation to Secretarial Fee and Tax Filing Fee Rules 2014 PU.

Complete medical examination for self spouse child Restricted to 500 9. 112019 - Benefits In Kinds. In the case of sole proprietorship business chargeable income is his or her individual income.

Expenses on free meals refreshment annual dinners outings corporate family day or club membership for staff. Vaccination expenses for self spouse or child. Only married individuals are eligible for this tax relief.

These expenses however will not be deductible if they are incurred in acquiring new rights or facilities as they are considered to be capital in nature. 19 rows Expenses of a private or domestic nature are expressly excluded from. Is directors medical expense tax-deductible in Malaysia.

Outgoings and Expenses. Rent expenses of business premises repair and maintenance of premises plant and machinery loan interest or borrowing cost subject to interest deduction restriction employee salaries allowance and statutory contribution stock in trade refer to sec 35 and many more. Under section 131 b Income Tax 1967 medical and dental benefits are exempt.

Since this donation is limited to 10 of his aggregate income he can claim RM6000 10 x RM60000 in tax deductions. Lifestyle Expenses for the use benefit of self spouse or child in respect of. In Budget 2020 to provide additional flexibility to.

To legislate the above-mentioned proposal the Income Tax Deduction for Expenses in relation to Listing on Access Certainty Efficiency ACE Market or Leading Entrepreneur Accelerator Platform LEAP Market of Bursa Malaysia Securities Berhad Rules 2020 PUA 263 were gazetted on 3 September 2020. Medical expenses for fertility treatment for self or spouse. Entertainment expenses in having ordinary course of business.

Whether particular outgoings or expenses are deductible is a well-litigated subject and while the scope of this is wide certain principles have emerged from case law. As we used to say staff are assets and therefore the expenses are tax deductible.

Personal Tax Relief 2021 L Co Accountants

Malaysia Income Tax 2022 A Guide To The Tax Reliefs You Can Claim For Ya 2021 Buro 24 7 Malaysia

Individual Income Tax In Malaysia For Expatriates

Tax Treatment For Entertainment Expenses

Malaysia Income Tax 2022 A Guide To The Tax Reliefs You Can Claim For Ya 2021 Buro 24 7 Malaysia

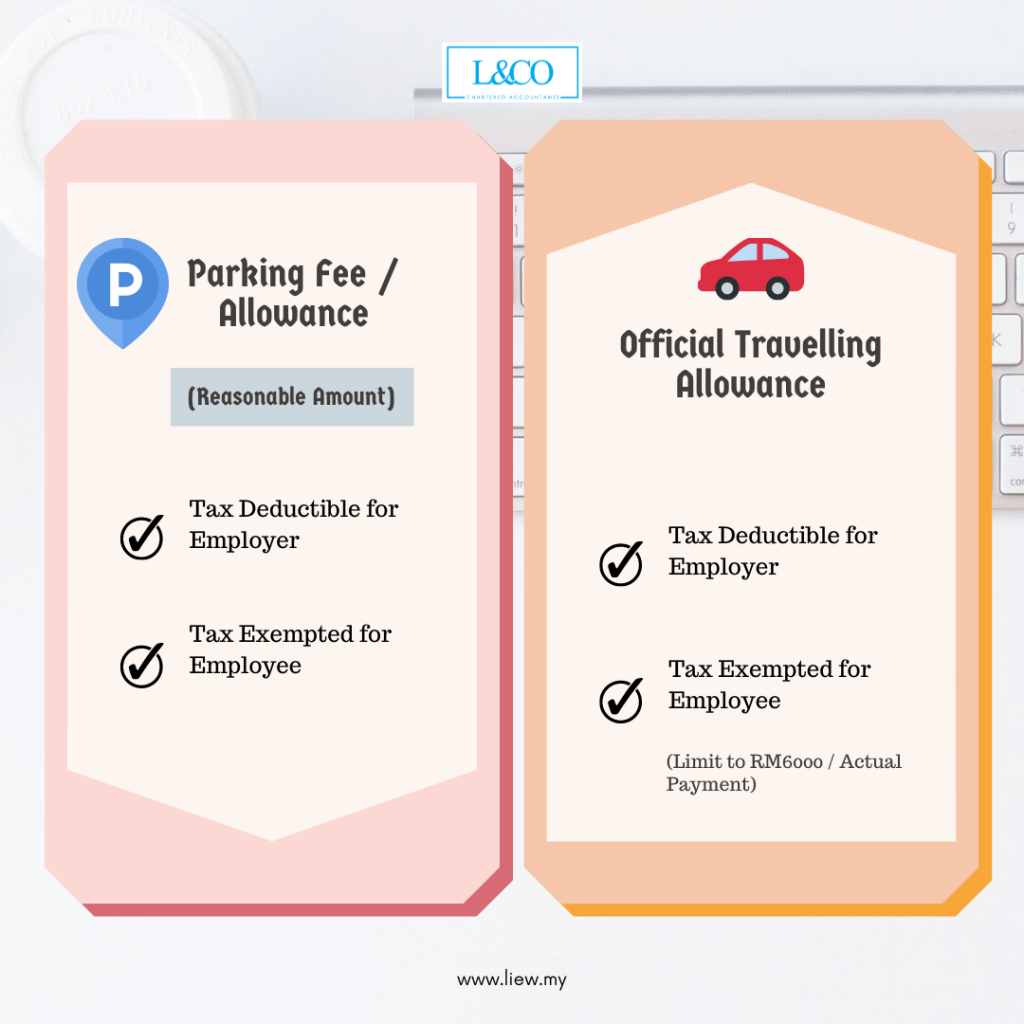

Employee Benefits That Are Tax Deductible Employers Tax Exempted Employees L Co

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

Types Of Taxes In Malaysia For Companies

Tax Treatment On Entertainment Expenses Asq

5 Key Facts You Probably Didn T Know About Tax Deductibles In Malaysia

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

Corporate Income Tax In Malaysia Acclime Malaysia

2020 Tax Relief What To Claim For Your Tax Deductions R Malaysia

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

Updated Guide On Donations And Gifts Tax Deductions

Tax Deductible Expenses The Malaysian Institute Of Certified

Malaysia Income Tax 2022 A Guide To The Tax Reliefs You Can Claim For Ya 2021 Buro 24 7 Malaysia

Home Inspection Template Excel Check More At Https Www Losangelesportalen Se Home Inspectio

Malaysia S Budget 2022 Key Takeaways For Employers And Hr To Note